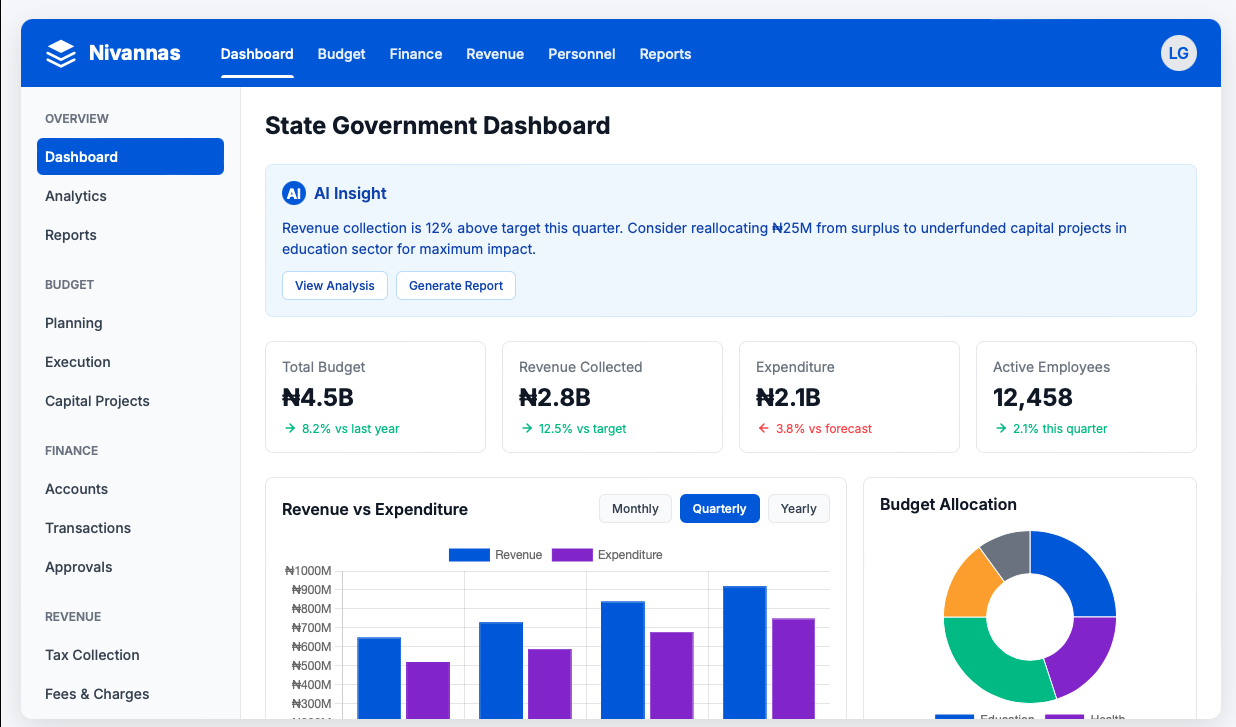

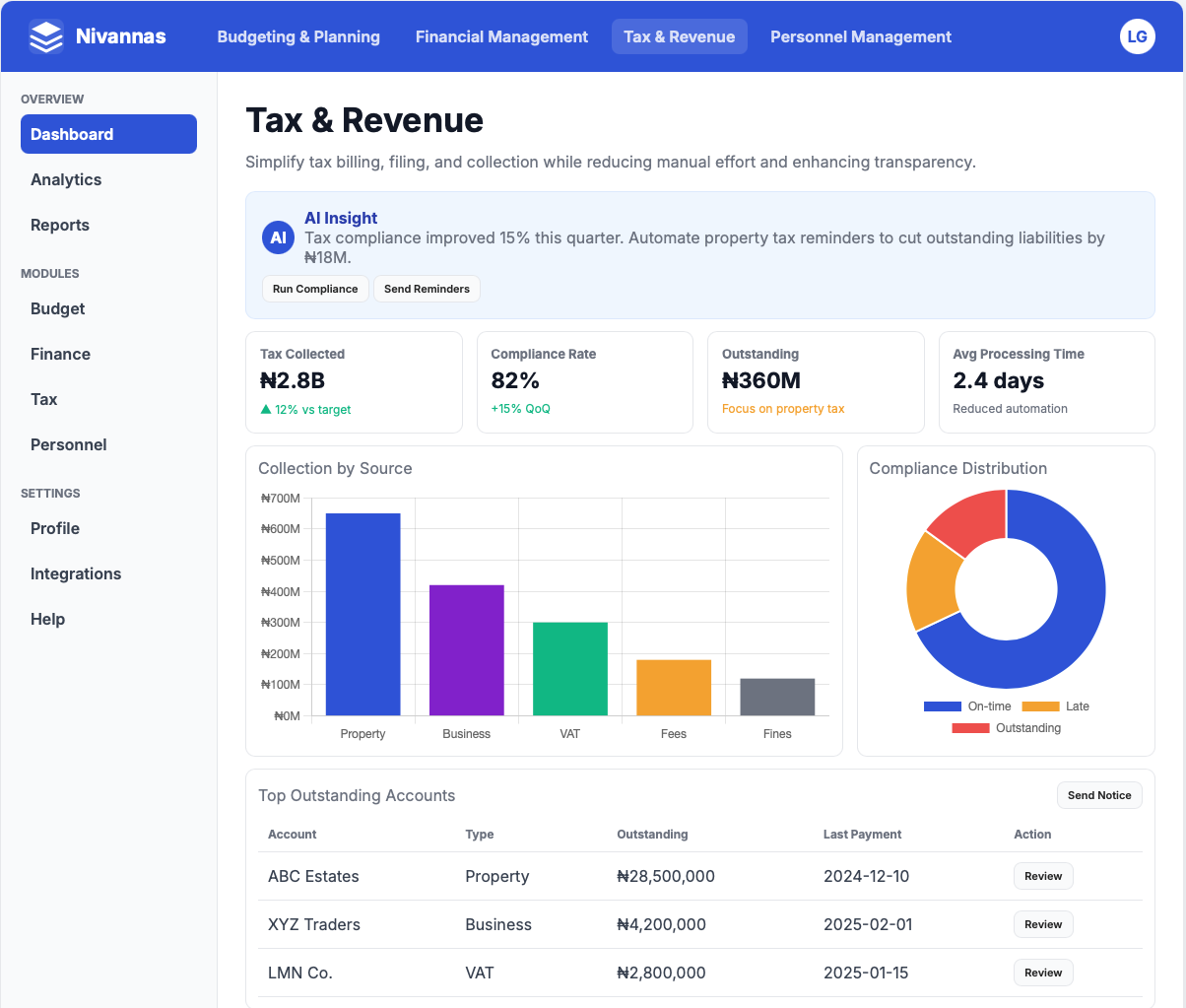

Tax & Revenue Collection

Maximize revenue collection and improve compliance with our AI-powered tax and revenue management solution for Nigerian government entities.

Key Features

Comprehensive tax and revenue collection tools designed for Nigerian government entities

Taxpayer Management

Maintain a comprehensive database of individuals and businesses with automated registration and verification processes.

Payment Processing

Accept multiple payment methods including bank transfers, USSD, cards, and mobile money with real-time reconciliation.

Compliance Monitoring

Identify non-compliant taxpayers with AI-powered analytics and automated notification systems.

Advanced Revenue Analytics

Our tax and revenue solution provides comprehensive analytics and reporting tools that enhance decision-making and forecasting.

-

Revenue Forecasting

AI-powered forecasting to predict future revenue streams and identify growth opportunities

-

Revenue Breakdown

Detailed analysis of revenue sources by type, location, and demographic segments

-

Geographic Insights

Visual mapping of revenue collection across different regions and local government areas

Benefits

Why Nigerian governments choose Nivannas for tax and revenue collection

Increased Revenue

Our clients typically see a 20-30% increase in revenue collection within the first year of implementation.

Improved Compliance

Automated reminders and easier payment options lead to higher voluntary compliance rates.

Reduced Fraud

Advanced fraud detection algorithms identify suspicious patterns and prevent revenue leakage.

Better Citizen Experience

User-friendly payment options and transparent processes improve citizen satisfaction.

Ready to Transform Your Revenue Collection?

Join the growing number of Nigerian governments using Nivannas to maximize their revenue potential